Closing Costs in Placerville, CA

Are you in search of the best home in Placerville, CA? Learning the average closing costs in Placerville, CA, is your first best move. Please read the compiled information below for more details or contact Rhonda Moffett-Florence for help.

What are Closing Costs?

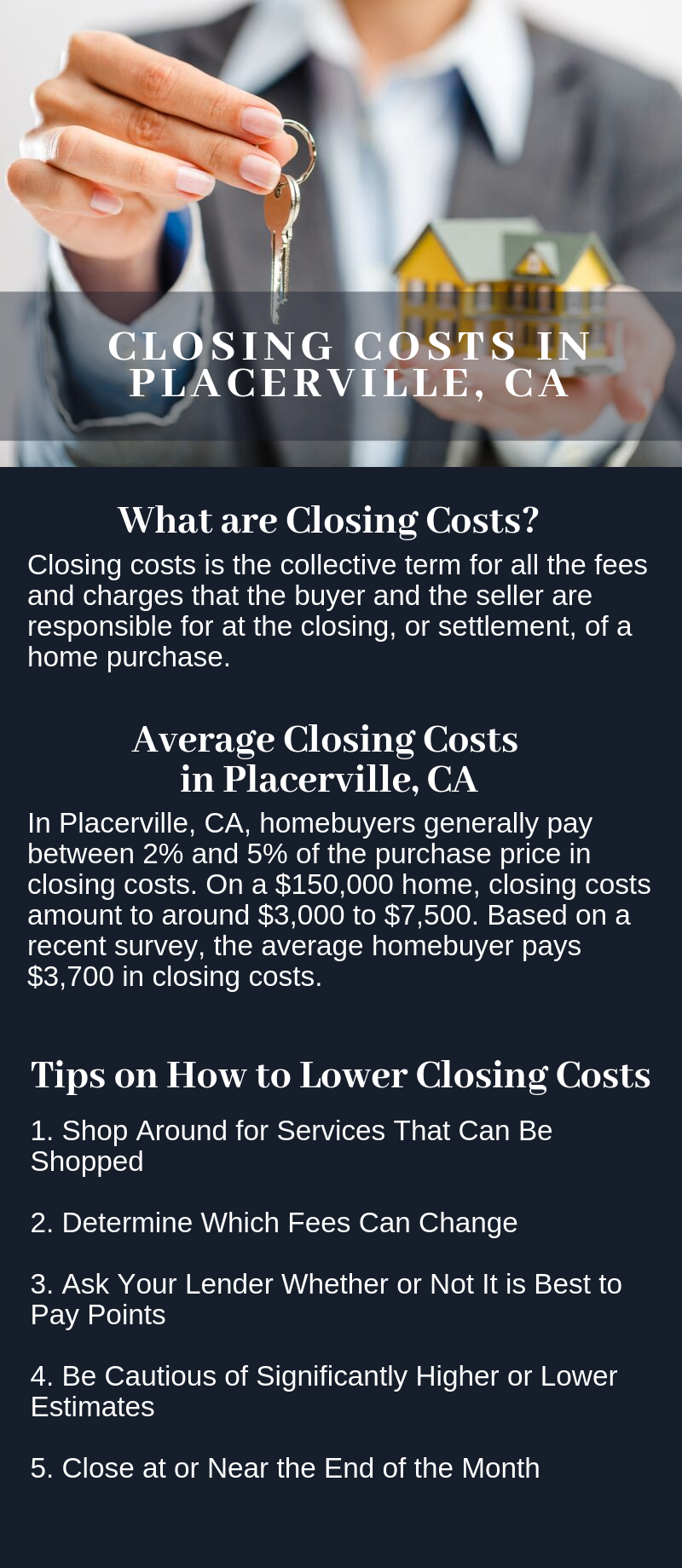

Closing costs is the collective term for all the fees and charges that the buyer and the seller are responsible for at the closing, or settlement, of a home purchase. In most cases, it is the buyer who shoulders most of the closing costs. However, depending on their negotiations, the seller may agree to pay for some or all of the costs. The fees and legal requirements involved at closing differ for each state and municipality, so it is best for homebuyers to work with a qualified and experienced real estate professional who can provide them with the appropriate assistance and guidance that will enable them to get the best deal out of their real estate transaction.

Average Closing Costs in Placerville, CA

Average Placerville, CA Buyer’s Closing Costs

In the state of California, home prices usually range from $600,000 to $700,000. For a residential property within this price range, expect to pay between $4,860 and $5,670 in closing costs, before taxes. These charges include home inspection, appraisal and origination costs, as well as title insurance and courier fees.

In Placerville, CA, the county seat of El Dorado County, the median home value for is $517,894 and homebuyers generally pay between 2% and 5% of the purchase price in closing costs. On a $150,000 home, closing costs amount to around $3,000 to $7,500. Based on a recent survey, the average homebuyer pays $3,700 in closing costs.

The cost of home inspection varies, depending on the inspector and the size and type of the property. Most home inspections cost between $250 to $750. If the homebuyer is taking out a mortgage to purchase the property, the lender would require an appraisal to ensures that the property is worth at least the purchase price. The appraisal fee for California VA borrowers has been set at $600 since 2016. For all other borrowers, appraisals typically cost between $400 to $600.

Average Placerville, CA Seller’s Closing Costs

Home sellers in California generally pay 5% to 9% in closing costs. One of these costs is the broker’s commission, which is the largest expense for sellers. The commissions paid to the realtors or real estate brokers usually amount to approximately 6% of the sales price. Of this 6%, 3% is paid to the buyer’s broker and 3% is paid to the seller’s broker.

Breakdown of Closing Costs for Homebuyers in Placerville, CA

- Closing Attorney

- Title Search

- Title Insurance

- Appraisal Fee

- Property Inspection Fee

- Recording Fee

- Origination Fee

- Points (Optional)

- Surveying Fee

- Settlement Fee

- Property Tax

- Condo or HOA Fees

- Flood Certification

- Credit Report

- Mortgage Recording or Deed of Trust

- Homeowners Insurance

- Hazard Insurance

- Mortgage Insurance

- Archive and Courier Fee

- Miscellaneous Condo Fees

- Mello-Roos CFD Taxes

- Broker Fees

- Own Attorney

- Transfer Tax

- Property Tax

- Document Preparation Fee

- Recording Fees

- Escrow Fees

- Mortgage Payoff

- Courier and Wire Transfer Fee

- Home Warranty Fee

- Condo or HOA Fees

- Miscellaneous Condo Fees

How Placerville Homebuyers Can Lower Their Closing Costs

The list containing all the fees and charges related to closing can be confusing and overwhelming, especially to first time homebuyers. However, it is important to keep in mind that closing costs are not set in stone and a lot of these are negotiable. So, if you are a homebuyer in Placerville, CA looking for ways to lower your closing costs, here are some helpful tips:

1. Find Out Which Services Can Be Shopped

While it is common practice for homebuyers to shop around for mortgage rates, this is not the only fee that you can shop for. Did you know that you can also shop around for title insurance and pest inspection fees? Yes, that’s right. Go through the details on your Loan Estimate to find out which services you can shop for and which ones you can’t so you can reduce your overall closing costs.

2. Learn Which Fees are Fixed and Which Ones Can Change

Remember that not all of the fees listed on your Loan Estimate are fixed, some of these can change. If you decide to use a company that your lender has recommended, for example, certain fees, such as your title services, lender’s title insurance, and owner’s title insurance cannot go up by more than 10% at settlement. On the other hand, if you choose to use other service providers not listed in the Loan Estimate, the costs could increase by even higher percentages.

3. Ask Your Lender About Discount Points

Although homebuyers are usually advised to pay discount points in order to get a lower interest rate, some experts would not recommend this when mortgage rates are already low. However, there are some who would still recommend that buyers pay points even when mortgage rates are low, especially to those who plan on keeping the property for the long haul. So, if you would like to know whether or not buying points would be advantageous for you, ask your lender.

4. Be on the Lookout for Overly High or Low Estimates

Despite the fact that closing costs vary in each state and municipality, most third-party fees are fairly comparable. So, if you notice third-party charges that are too high or too low compared to the average, you would need to ask the lender about these before you decide to use them as your lender or title insurance provider.

5. Set Your Closing Date at or Near the End of the Month

You can save on prepaid interest when you schedule your settlement date towards the end of the month, as this particular expense accrues from the closing date to the end of the month. So, in effect, the closer your closing date is towards the end of the month, the lower your prepaid rate is, given that there are fewer days in between these two dates. For example, if you have set the closing date on the 15th of the month, you will have to pay for 15 days of interest; whereas scheduling the closing date on the 30th would only cost you a day’s interest.

If you are in the market to buy a home in the lovely location of Placerville, CA, my team and I will be very happy to show you all your best options in this area. Feel free to give me a call at 530-647-0865 or send me an email at Team@PlacervilleHomes.com to schedule an appointment.

Closing Costs in Placerville, CA Related Information

Best Schools in Placerville, CAPlacerville, CA Real Estate Market Report

Cost of Living in Placerville, CA

Best Restaurants in Placerville, California